Nvidia Resumes $20 Billion H20 AI Chip Sales to China: Impact on Asian Tech Stocks & Market Cap Surge

By Alex Grant

Picture this: You're at a hawker center in Singapore, and the uncle running your favorite noodle stall suddenly tells you he can't serve beef anymore—government rules. Three months later, he's back with a smile saying "beef is back on the menu." That's essentially what happened to Nvidia this week, except we're talking about $20 billion worth of AI chips heading to China.

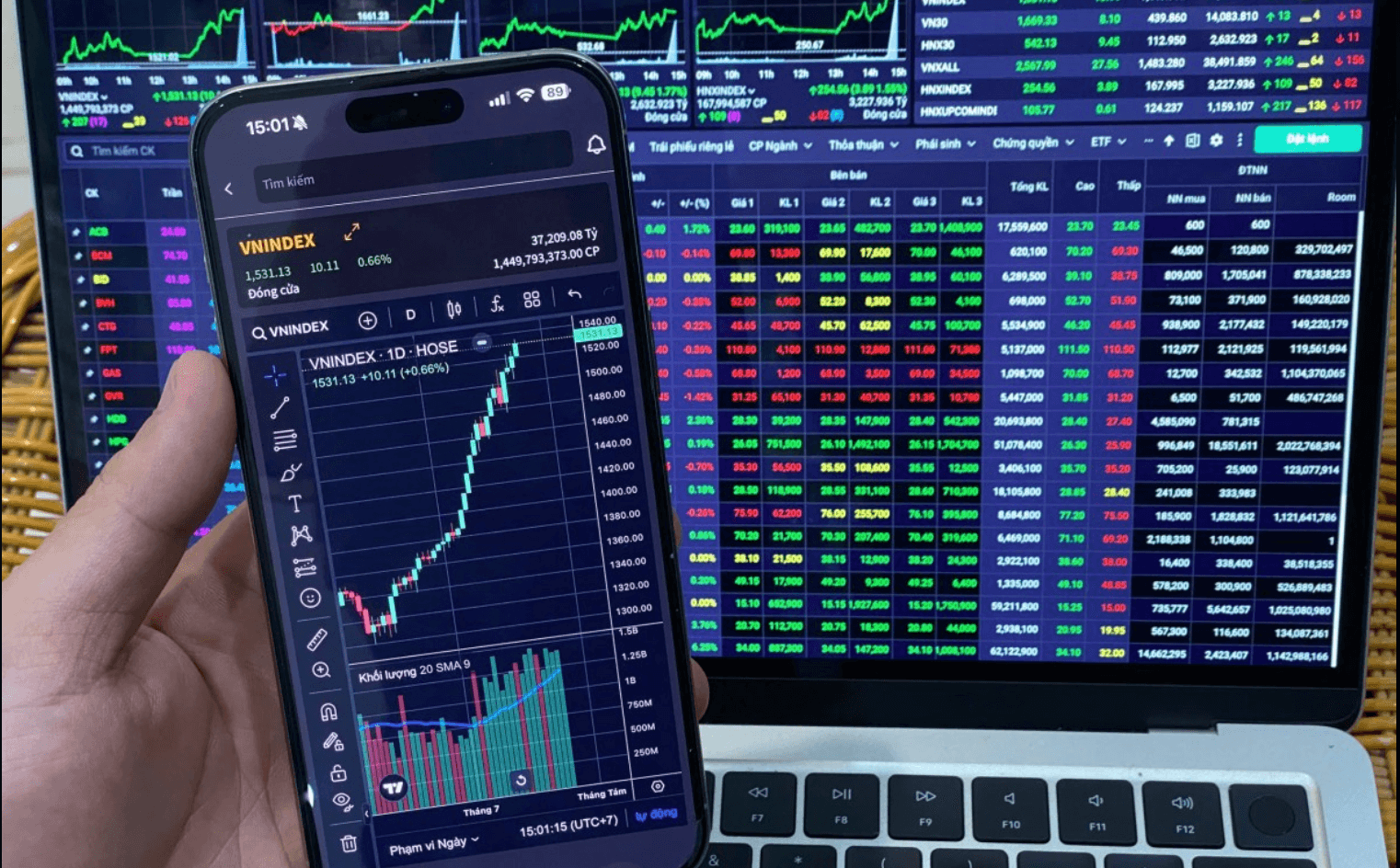

Nvidia stock rocketed 5% in premarket trading Tuesday, closing above $171 after hitting a record $164.92 last week. The catalyst? The company announced it's applying to resume sales of its H20 AI chips to China—chips banned by the Trump administration in April—with the US government already assuring "licenses will be granted."

What Actually Happened Here?

Let's rewind to April 2025. The Trump administration dropped a surprise export ban on H20 chips—specially designed, lower-powered versions of Nvidia's flagship AI processors created for the Chinese market. Think of H20s as the "diet coke" version of Nvidia's full-strength AI chips, made to comply with previous US export restrictions.

The ban hit Nvidia like a freight train: $2.5 billion lost in Q1 revenue, with a projected additional $8 billion loss for Q2. To put that in perspective, that's roughly equivalent to Singapore's entire annual defense budget—gone in six months.

But CEO Jensen Huang didn't sit idle. He personally lobbied President Trump at the White House last week before heading to Beijing for his second China visit this year. Those conversations worked. Nvidia became the first public company to reach a $4 trillion market cap in July 2025, cementing its position as the world's most valuable company by market capitalization.

The Numbers That Matter

Just one step to unlock the rest of this article

Sign in to read the full article and access exclusive content

✨ Completely free • No credit card required