VN-Index Targets 1,700 Points: Opportunities and Challenges for Vietnam's Stock Market

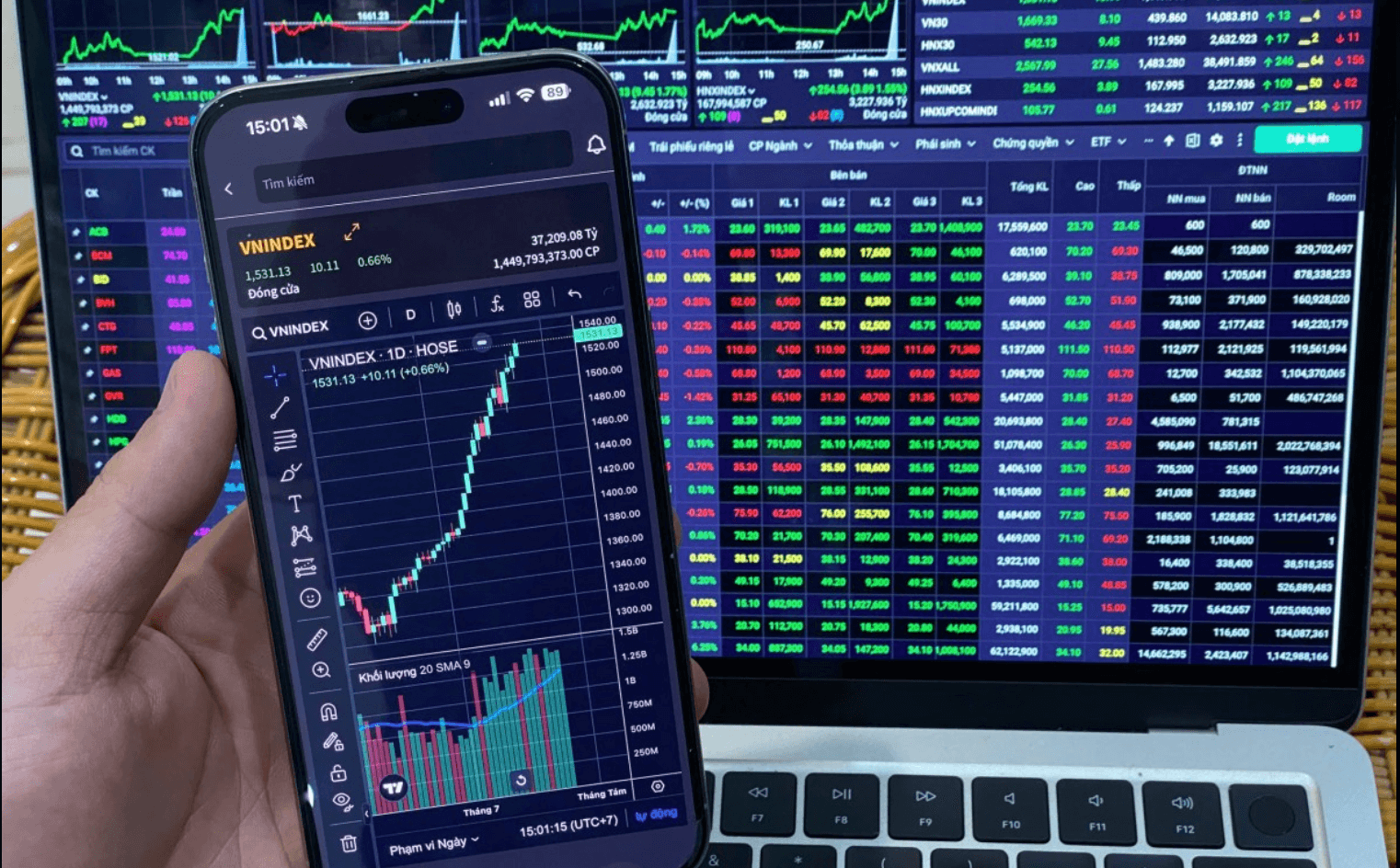

Positive Momentum from August

From the perspective of a trader who has monitored various markets, I see the nearly 12% surge in VN-Index during August as a very positive signal. The index targeting the 1,700-point milestone shows Vietnam's market structure is in a healthy growth phase, something that those applying price action analysis like myself can clearly recognize.

Looking back at my journey from losing $1000 in forex, I learned that when a market has such strong momentum, it's usually the result of a combination between solid fundamentals and perfect technical setup. VN-Index is currently displaying exactly this pattern.

Domestic Capital Flow - The Main Driver

Experience in market analysis using Al Brooks' methodology helps me recognize that strong domestic capital flow is the backbone of this surge. Unlike previous periods when the market depended heavily on foreign capital, this time Vietnamese retail investors are more confident in investing in their own home market.

From my business trips to Ho Chi Minh City, I've witnessed firsthand the change in Vietnamese investors' psychology. Individual investors are no longer just depositing savings but are actively participating in the stock market with clearer knowledge and strategies.

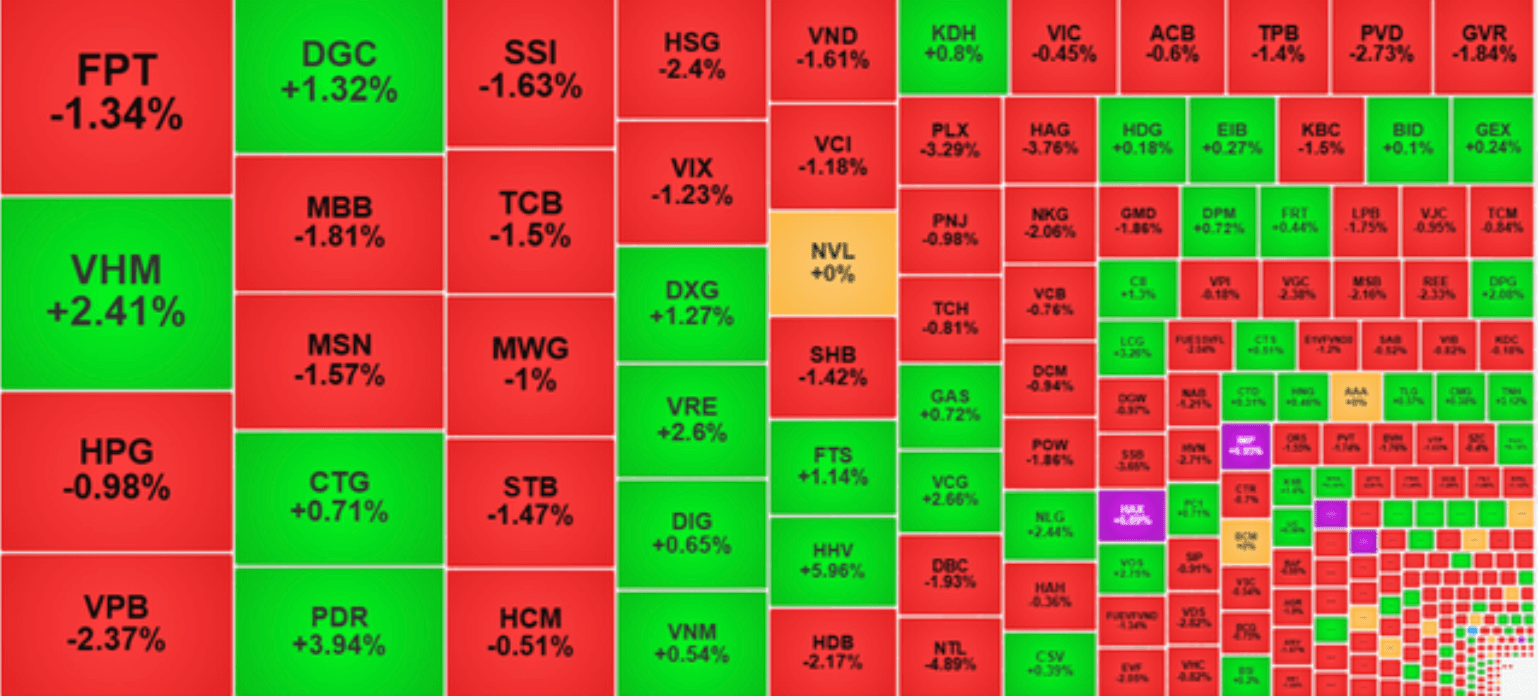

Pillar Sectors Leading the Way

According to Bob Volman, sector rotation is an important part of market analysis. Banking, securities, and real estate continuing to play pillar roles isn't coincidental. These are sectors with strong fundamentals and are directly benefiting from Vietnam's economic growth trajectory.

Just one step to unlock the rest of this article

Sign in to read the full article and access exclusive content

✨ Completely free • No credit card required