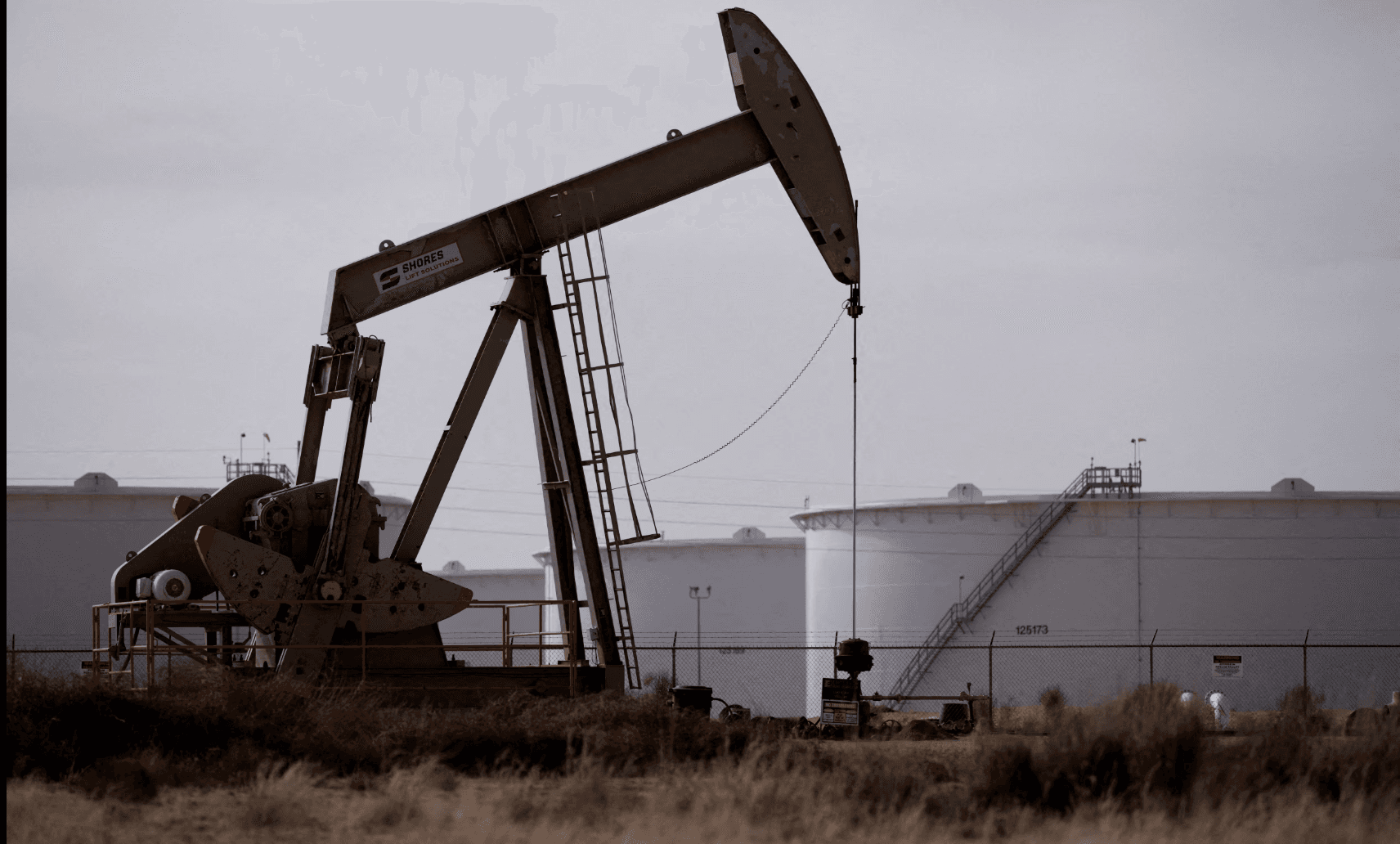

Brent Oil Rises Slightly to $67.86: Analysis of US Inventory Decline and Geopolitical Tensions

When US Inventories Fall More Than Expected

Today (August 25, 2025) world oil prices rose slightly with Brent crude reaching around $67.86/barrel. From my commodity market monitoring experience that Bob Volman taught me, changes in inventories are often important catalysts for price volatility. US crude oil inventories falling more sharply than expected created upward price pressure as supply is seen tightening.

Supply-Demand Analysis and Market Psychology Impact

According to the price analysis method Al Brooks guided, when supply data shows tighter conditions than expected, markets usually react positively immediately. With the TramNgo FX-Crypto Community, we understand that crude oil isn't just a simple commodity but also a barometer of global economic health.

Geopolitical Factor: Russia-Ukraine Still Unknown

Prolonged geopolitical instabilities between Russia and Ukraine remain unresolved, increasing concerns about global supply disruption risks. As I analyzed in previous articles about Trump's proposed three-way summit, this situation remains highly uncertain. Oil markets are very sensitive to such news because Russia is one of the world's largest oil exporters.

OPEC+ Role in Market Regulation

Oil markets are also affected by OPEC+ production decisions and energy policy moves by major countries. From my experience analyzing market makers, I see OPEC+ playing a role like a central bank of the oil market - they can strongly impact prices by adjusting production quotas.

Global Demand: Drivers and Challenges

Just one step to unlock the rest of this article

Sign in to read the full article and access exclusive content

✨ Completely free • No credit card required