Agricultural Recovery and International Tax Pressures: What Signals for Global Trade?

Coffee and Rubber Recovery

The recovery in coffee and rubber prices due to supply shortages reflects fundamental changes in global agricultural commodity markets. From the perspective of a trader who has monitored commodity markets, I see this as the result of multiple combined factors: adverse weather in major production regions, rising input costs, and changes in global supply chains.

Looking back at my journey from losing $1000 in forex, I learned that commodity cycles usually have long-term characteristics and are heavily influenced by supply constraints. Al Brooks once taught me about the importance of understanding supply-demand fundamentals, and in the case of coffee-rubber, the supply side is the main driver.

Impact of Supply Reduction

Bob Volman once emphasized that in commodity trading, supply shocks usually create stronger and more sustainable price movements compared to demand changes. The reduction in coffee supply may come from: drought in Brazil, crop diseases, or farmers switching to other crops due to low prices in the past.

Luna, my ragdoll cat, always knows how to adjust behavior when food sources change. Similarly, commodity markets are also adjusting prices to balance new supply-demand dynamics.

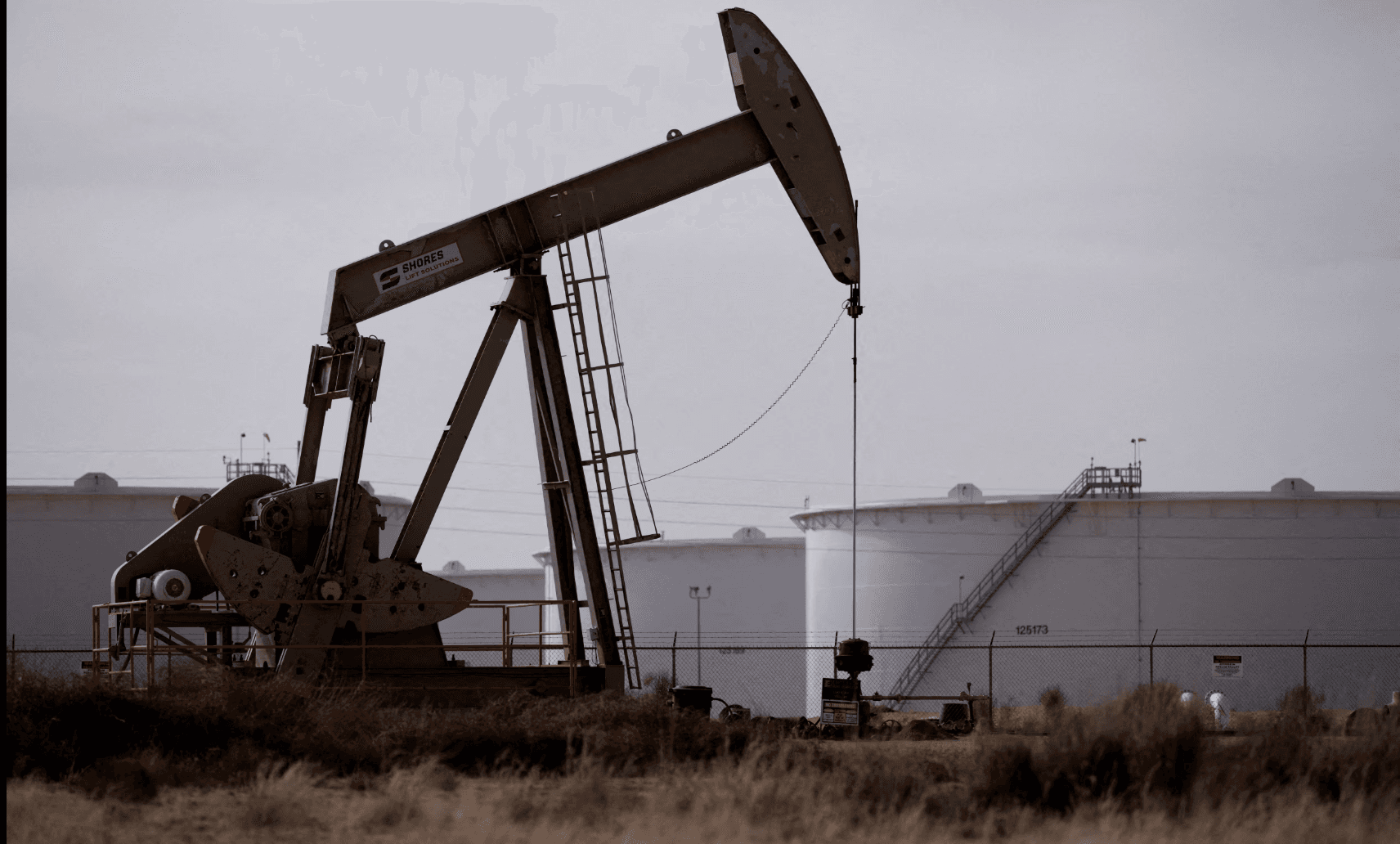

Challenges from Tax Policies

In TramNgo FX-Crypto Community, I often explain about the impact of trade policies on commodity prices. E-commerce tax regulations and US tariffs create additional layers of complexity for global trade:

E-commerce taxes may affect how agricultural products are sold and distributed, especially with digitization in agricultural trading. US tariffs create uncertainty and may redirect trade flows, affecting pricing mechanisms.

Just one step to unlock the rest of this article

Sign in to read the full article and access exclusive content

✨ Completely free • No credit card required