Vietnamese Government Issues Decree 232: End of Gold Bar Monopoly - Opportunity or Challenge for the Market?

Historic Turning Point in Vietnam's Gold Market

On August 26, 2025, the Vietnamese Government officially issued Decree 232/2025/ND-CP, ending the state monopoly on gold bar production. This is a decision that could completely change the domestic gold market landscape we've been familiar with for many years. From my experience analyzing financial policies, I see this as a bold move that could create far-reaching impacts.

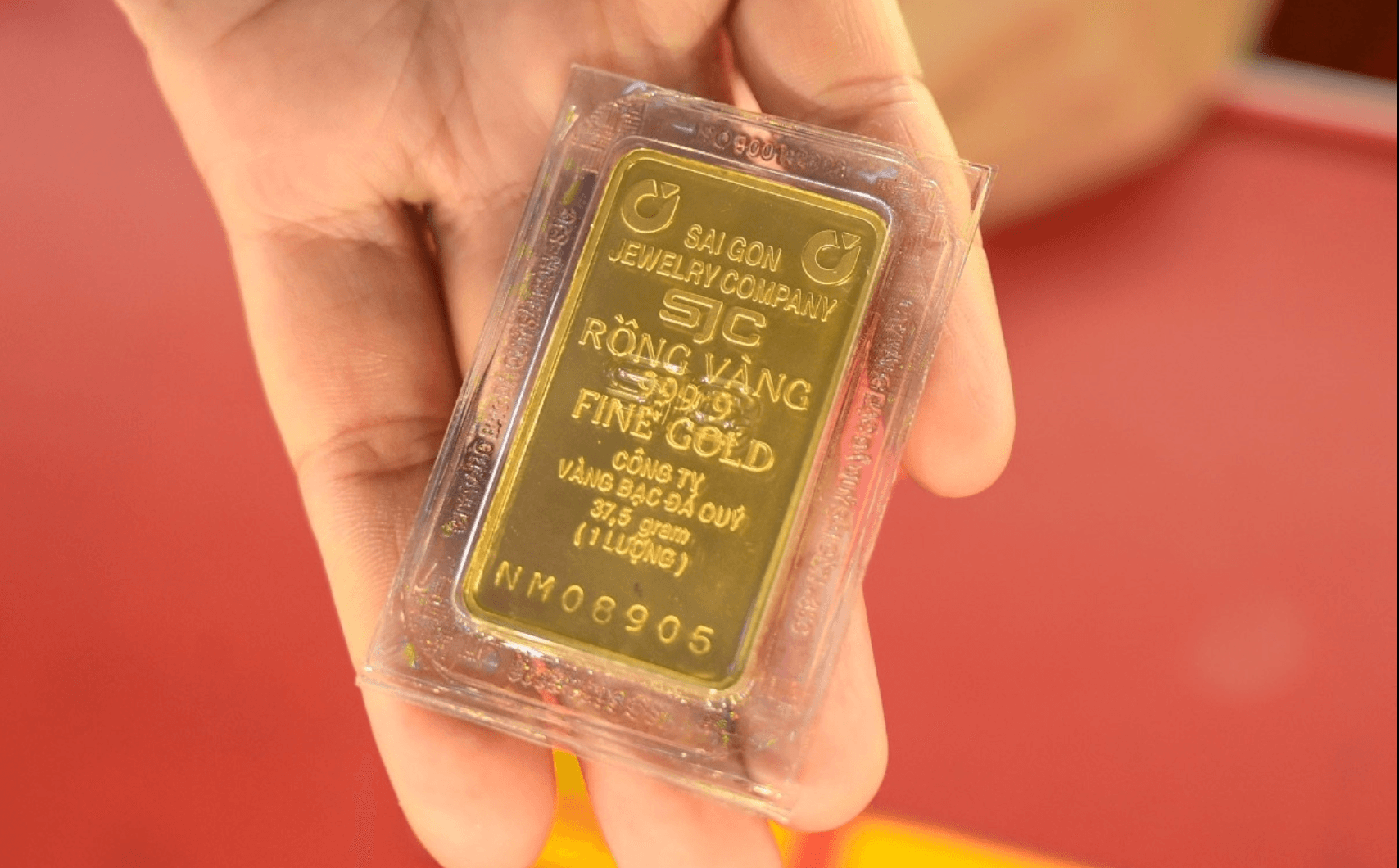

"Strict" Conditions for Participating Units

According to the new decree, gold bar production will be open to enterprises with capital from 1,000 billion VND and commercial banks with capital from 50,000 billion VND. These are quite massive numbers showing the Government wants to ensure only organizations with strong financial capacity can participate. Bob Volman taught me that in any market, high barriers to entry usually create fewer players but higher quality ones.

From Monopoly to Controlled Licensing

The gold bar production market will shift from monopoly to a controlled licensing mechanism, with the State maintaining management roles through issuing licenses for production, import and export of gold raw materials. With the TramNgo FX-Crypto Community, we understand this is quite a smart hybrid model - both opening the market while maintaining control.

Transfer Regulations: Transaction Transparency

A notable point is the regulation requiring gold transactions of 20 million VND/day or more to be conducted via bank transfers through commercial banks. This aims to increase transparency, combat money laundering and control money flows. From Al Brooks' experience monitoring money flows, this will help regulators have clearer views of the gold market.

Impact on Current Price Gaps

Just one step to unlock the rest of this article

Sign in to read the full article and access exclusive content

✨ Completely free • No credit card required