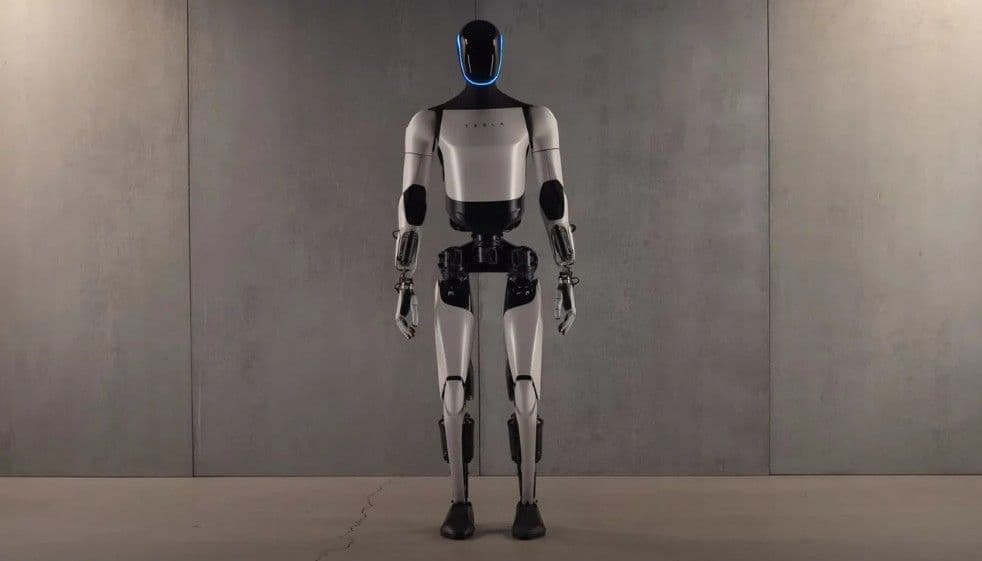

Tesla Optimus Robot Faces Production Setbacks as Chinese Robotics Manufacturing Surges Ahead

Tesla's humanoid robot dreams are melting faster than ice cream in a Saigon summer, and Chinese manufacturers are collecting the puddle with industrial-grade efficiency. While Elon Musk promised 5,000 Optimus robots by 2025, his team is reportedly stuck debugging overheating joint motors—a problem that sounds less "revolutionary AI" and more "freshman engineering homework gone wrong." This gap is rapidly shifting the balance of power in the global robotics market, with long-term implications for investors tracking the automation sector.

The Situation: When Robots Need Therapy More Than Humans

Tesla's Optimus production delays have hit the pause button after burning through millions in R&D and producing more engineering headaches than actual robots. The company's humanoid robots are experiencing joint motor overheating issues that force them to take more breaks than a unionized factory worker. Meanwhile, Chinese robotics firms like UBTech and Fourier Intelligence are scaling manufacturing capacity toward an estimated 8,000-12,000 industrial and service robots by 2025—roughly double Tesla's original ambitious target, but delivered with the reliability of a Honda Civic instead of the volatility of a crypto portfolio.

The numbers tell a sobering story for Tesla Optimus production: China already controls approximately 40% of the global robotics market, with annual growth rates of 23% heading toward a $108 billion valuation by 2028. By some estimates, foreign suppliers' market share in China has dropped from over 70% in 2020 to just 53% in 2023. As Vietnamese entrepreneurs know, "Có công mài sắt có ngày nên kim" (with persistence, even iron can be ground into a needle)—and Chinese robotics manufacturing has been grinding while Tesla tweets.

How We Got Here: From "Move Fast and Break Things" to "Move Slow and Overheat Everything"

Tesla's robot engineering setbacks mirror their earlier Model 3 production disasters, when Musk admitted that "excessive automation was a mistake." Chris Walti, Tesla's former Optimus team lead, recently told Business Insider that humanoid robots were "the wrong option for factory work," describing them as "a ninth-inning robotics problem" when the industry is still "in the third inning."

This isn't Tesla's first thermal management rodeo. The company has faced multiple recalls for overheating CPUs in vehicle infotainment systems, though their world-class battery cooling expertise doesn't translate directly to compact robot joints where space constraints are exponentially tighter. When your robot needs more downtime than a meditating monk, you've missed the point of automation entirely.

Chinese competitors, meanwhile, have been quietly building partnerships like UBTech Robotics with Dongfeng Liuzhou Motor, deploying actual working robots in real factories. UBTech alone has robots operating in over 40 Chinese manufacturing facilities as of 2025. While Tesla engineers debug motor temperatures, Chinese robotics firms benefit from domestic supply chains that control rare earth magnets and neodymium—the critical components Tesla struggles to source due to export restrictions affecting robot actuators.

Just one step to unlock the rest of this article

Sign in to read the full article and access exclusive content

✨ Completely free • No credit card required