S&P 500 Breaks New Ground: Smart Investment Strategies for Vietnamese Investors

Do you know why the S&P 500 keeps setting records and what this means for every dollar you invest from Vietnam? The U.S. stock market has once again asserted its global leadership as the S&P 500 rose 0.32% to 6,501.86 points on August 28, 2025, breaking the record set just two weeks prior. This isn't just dry statistics—it's a crucial signal that we, as young Vietnamese investors, cannot afford to ignore.

What's Driving the S&P 500 "Growth Engine"?

Like a marathon runner, the S&P 500 is maintaining a steady but persistent pace. This seemingly modest 0.32% gain actually demonstrates something important: stability. Instead of volatile spurts, the U.S. market is showing real strength through sustainable growth built on solid fundamentals.

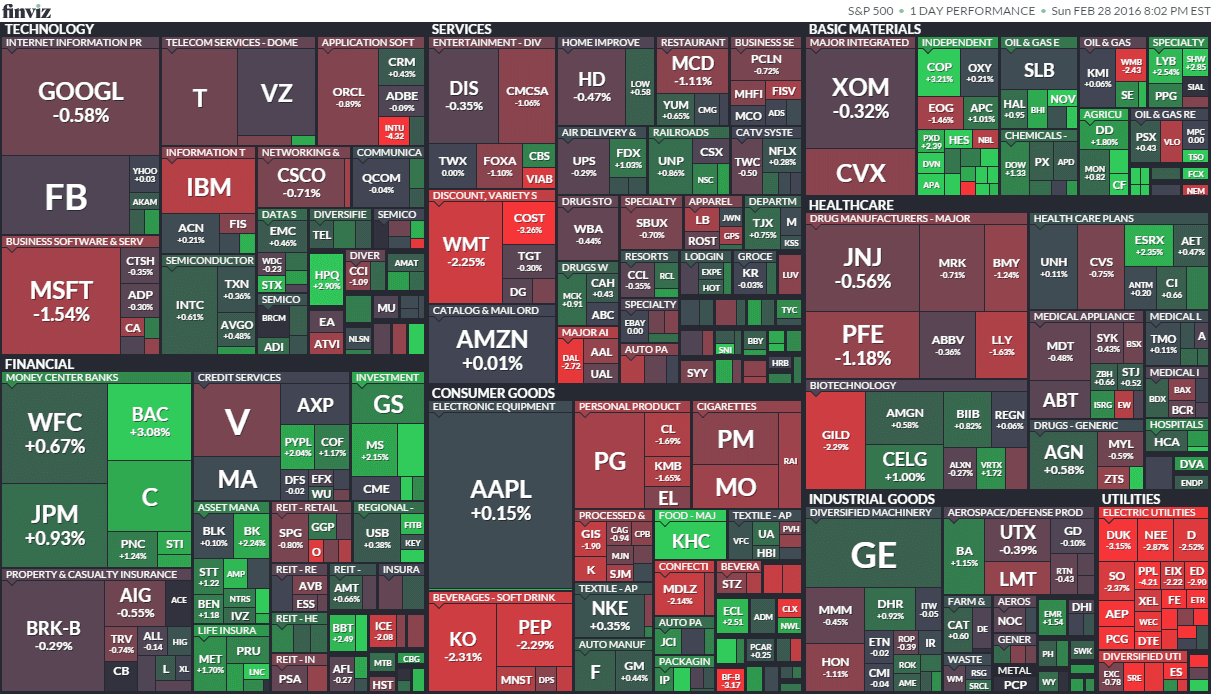

The primary momentum comes from three pillars: impressive earnings from tech giants, supportive monetary policy from the Fed with current benchmark rates at 4.25-4.50% (with signals of potential cuts from Chairman Powell), and robust recovery in U.S. consumer spending. Notably, the technology, financial, and healthcare sectors continue to lead the charge, creating a positive "domino effect" across the entire market.

Why Should We—Vietnamese Investors—Care?

The S&P 500 is like a "lighthouse" for global financial markets. When it shines bright, the light spreads everywhere, including Vietnam's stock market. Data shows that during periods of strong S&P 500 growth, foreign capital inflows into Vietnam can surge to billions of USD, especially with prospects for market upgrading. Large-cap stocks like VIC, VHM, and FPT are typically the preferred destinations for this capital.

However, this relationship isn't always "perfectly synchronized." Sometimes, local factors like economic policy and domestic corporate performance have stronger impacts. The key is understanding the "rules of the game" to capitalize on opportunities while mitigating risks.

Golden Lessons for Young Investors

Patience is the Golden Key

Imagine you invested in the S&P 500 ten years ago with $400 (10 million VND). With average annual returns of 10-12%, that investment could have grown to approximately $1,400-1,600 today. This isn't a fairy tale—it's the result of patience and long-term vision.

Just one step to unlock the rest of this article

Sign in to read the full article and access exclusive content

✨ Completely free • No credit card required