Fed Rate Cut in September: Impact and Opportunities for Vietnam's Gold Market

Why can a decision from Washington change the fate of millions of investors in Vietnam? The answer lies in the Federal Reserve's imminent rate-cutting cycle beginning in September, with a 90% probability according to the CME FedWatch Tool—a "financial earthquake" that could reshape the entire investment landscape from the US to Vietnam.

After nearly two years of "brutal" rate hikes to 5.25-5.5% to combat inflation, the Fed is showing clear signals of a policy "pivot." This doesn't just affect the USD or US equities, but creates powerful ripple effects reaching Vietnam's gold market—where precious metals just hit a record 127 million VND per tael last week.

Is this the beginning of a global financial revolution? And how can Vietnamese investors capitalize on this "super cycle"?

Fed's U-Turn: When Inflation Pressure Is No Longer Priority #1

To understand the significance of Fed rate cuts, we need to look back at the recent "harsh" journey. Since March 2022, the Fed has continuously raised rates through 11 adjustments, from near 0% to 5.25-5.5%—the highest level in 22 years.

The goal? Defeat inflation that peaked at 9.1% in June 2022—the highest in 40 years. And the strategy worked: US inflation in July 2025 dropped to 3.2%, approaching the Fed's 2% target.

Jerome Powell, Fed Chairman, made a "turning point" statement at the August Jackson Hole meeting: "The time has come to adjust monetary policy. We will do whatever is necessary to support a strong labor market." However, he also cautioned: "Specific decisions will depend on economic data; we will not rush."

But the "medicine" of high rates has had serious side effects. The US labor market shows signs of slowing with only 114,000 new jobs created in July—far below the expected 175,000. The unemployment rate rose to 4.3%, the highest in three years.

"Domino Effect" from Washington to Saigon

When the Fed cuts rates, a chain reaction activates worldwide:

USD Weakens - Gold "Takes Flight": Lower rates make the USD less attractive, causing investors to withdraw capital seeking higher returns. Gold—priced in USD—becomes cheaper for buyers using other currencies. Moreover, low rates reduce the "opportunity cost" of holding gold.

Capital Flows to Risk Assets: Investors will seek higher returns in emerging markets. Vietnamese stocks already rose 8% in August, reflecting expectations of foreign capital inflows.

Real Estate Benefits: Low rates reduce borrowing costs, boosting real estate investment. In Ho Chi Minh City, apartment prices increased 12% in Q2 compared to the same period last year.

Mr. Nguyen Duc Tai, Analysis Director at VNDirect Securities, commented: "Fed rate cuts will create major opportunities for Vietnam's market. We forecast the VN-Index could reach 1,400-1,450 points by end-2025."

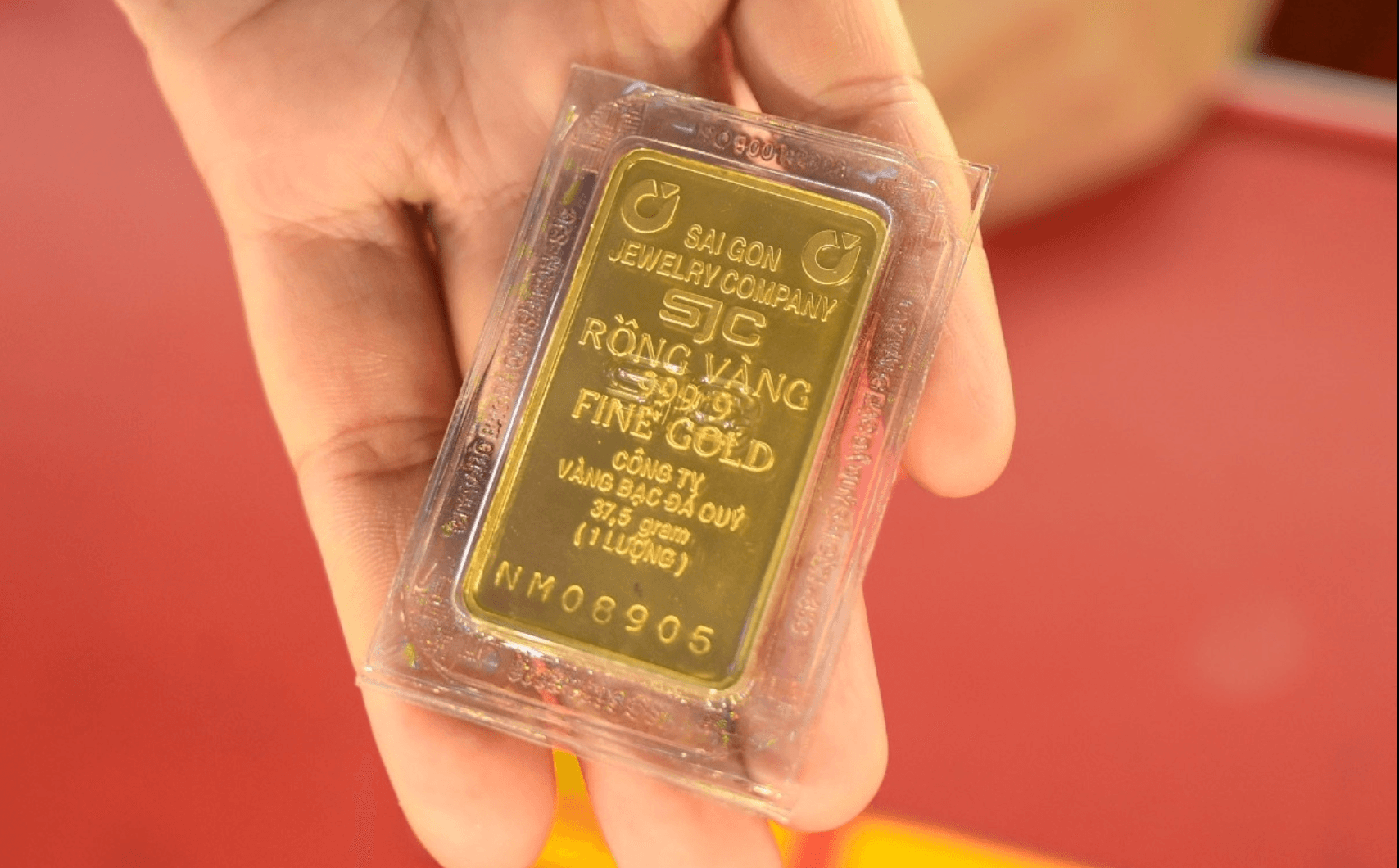

Vietnamese Gold: From "Fever" to "Super Cycle"?

The Fed's impending rate cuts have created global "gold fever," but in Vietnam, this phenomenon is further "amplified":

Latest data shows that over the past three weeks, SJC gold prices surged from 118 million to 127 million VND per tael—a 7.6% increase. Trading volumes at major gold shops like SJC and DOJI increased 150-200% compared to the previous month.

Ms. Minh Thu, a gold shop owner in District 1, shared: "Customers queue from early morning to buy gold. Many people buy 5-10 taels at once, saying they're 'investing for the future.' I've been in this business for 15 years and have never seen this scene."

FOMO Psychology Spreads: Seeing continuous gold price increases and news about Fed rate cuts, many people fear "missing out" and rush to buy.

Supply Shortage: The State Bank maintains its policy restricting gold imports, creating a spread of up to 53 million VND per tael compared to global prices.

Inflation Expectations: Many experts warn Fed rate cuts could reactivate inflation, making gold an attractive safe-haven channel.

However, not everyone is optimistic. Dr. Can Van Luc, economist at BIDV, emphasizes: "Current gold prices are too high compared to intrinsic value. Investors need to be cautious about sharp correction risks."

Just one step to unlock the rest of this article

Sign in to read the full article and access exclusive content

✨ Completely free • No credit card required