Bitcoin Crosses $100,000 Again: Unpacking the Latest Rally

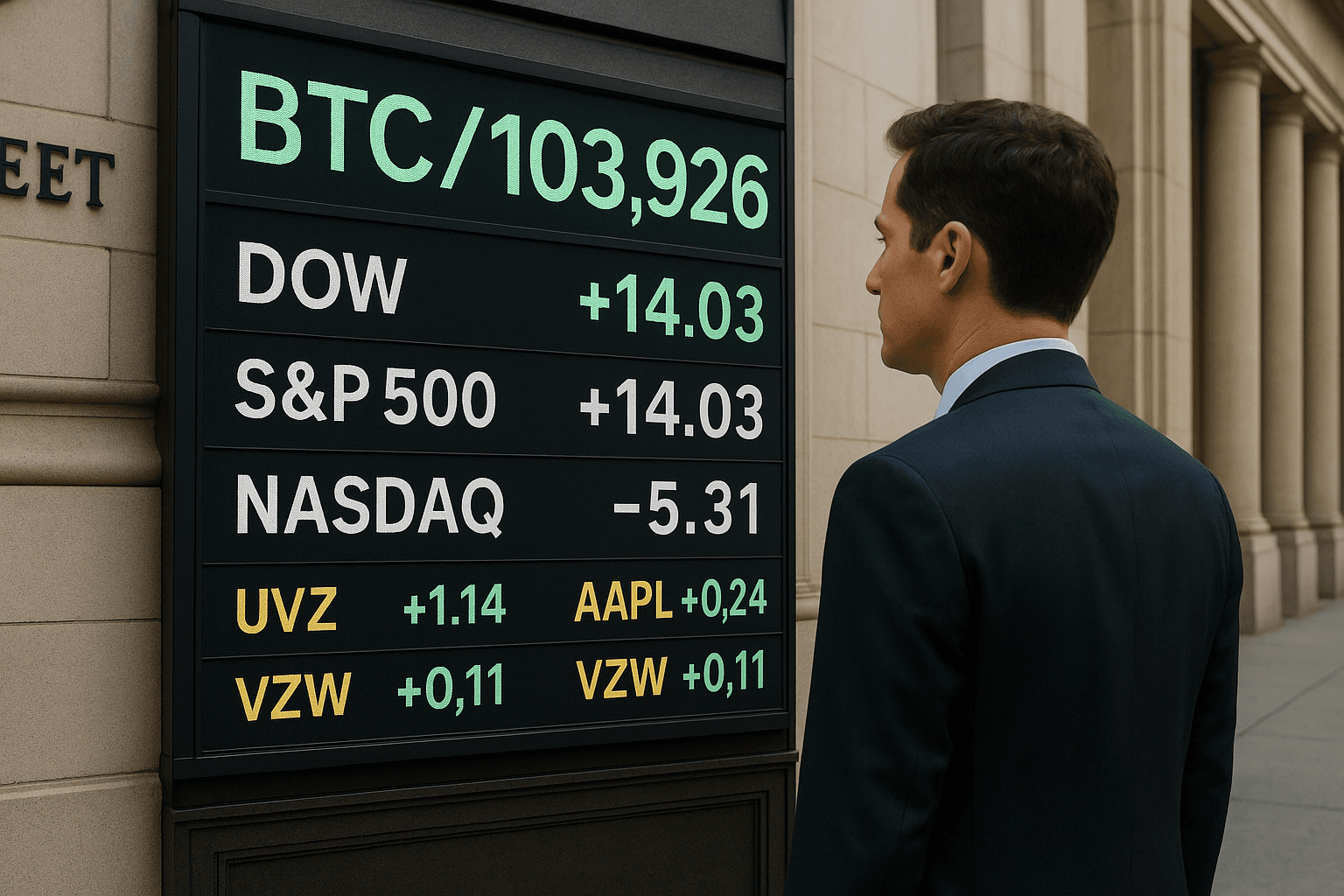

The digital asset's third journey above six figures represents a maturing asset classBitcoin's latest ascent above $100,000 on May 8, 2025, marks its third journey beyond this significant threshold, further cementing cryptocurrency's evolution from speculative curiosity to institutional mainstay. At $103,926 as of May 12, Bitcoin continues validating years of predictions and reinforcing its status as a legitimate asset class, transforming global investment strategies and challenging traditional financial paradigms.

A New Era for Bitcoin: The Path to Six Figures

The world's first cryptocurrency broke the $100,000 barrier for the third time on May 8 and has continued climbing to reach $103,926 by May 12, capping a remarkable 33% surge since April amid shifting macroeconomic winds and growing institutional confidence. This latest milestone follows Bitcoin's historic first breach of $100,000 on December 5, 2024, after the appointment of a crypto-friendly SEC chair, and a subsequent rally above this level in early February 2025.The May resurgence comes after a dramatic 32% plunge in April when President Trump's "Liberation Day" tariffs briefly sent Bitcoin tumbling below $75,000 from its January high of $109,241, which had represented a new all-time record following the initial December 2024 breakthrough."This third crossing of $100,000 isn't just another number—it represents institutional conviction in Bitcoin's long-term value proposition and demonstrates the market's growing maturity," notes Michael Saylor, CEO of MicroStrategy, which has accumulated 555,450 BTC worth approximately $57.7 billion at current prices.Each return to six figures has established stronger market foundations. The current rally is defined by Bitcoin's stunning outperformance against traditional assets, beating stocks in 10 of 17 trading sessions since April 2 and outpacing gold's 11% increase with its own 33% gain. More tellingly, Bitcoin's dominance in the cryptocurrency market has surpassed 60%, a technical signal that analysts predict could climb to 71% in coming months as capital flows increasingly concentrate in the market leader.

Institutional Revolution: The New Driving Force

Bitcoin's latest surge isn't fueled by the retail speculation that characterized previous bull runs. Instead, sophisticated institutional investors are driving the market with unprecedented conviction, fundamentally altering Bitcoin's price dynamics and volatility profile.Spot Bitcoin ETFs, launched in early 2024, have transformed market accessibility and legitimacy. These investment vehicles recorded $142 million in inflows on May 7 alone, reversing $85 million in outflows from the previous week. Total net inflows have now exceeded $35 billion this year, though daily averages of $129 million still lag behind January's $700 million peaks—suggesting substantial room for growth as institutional adoption accelerates."The ETF approval represented a fundamental inflection point for Bitcoin as an asset class," explains Cathie Wood, CEO of ARK Invest. "We're witnessing the early stages of a generational asset reallocation as Bitcoin increasingly competes with gold and government bonds in institutional portfolios."Beyond ETFs, sovereign wealth funds and central banks have emerged as powerful market entrants. Abu Dhabi's sovereign wealth fund and the Swiss National Bank have established significant positions, while speculation about a U.S. strategic Bitcoin reserve has further fueled institutional interest. This structural shift in buyer composition has coincided with Bitcoin's impressive 1.72 Sharpe ratio—a measure of risk-adjusted returns—second only to gold among major assets, underscoring its evolution into both a hedge against uncertainty and a growth engine in diversified portfolios.

Macroeconomic Catalysts: Policy Shifts and Market Dynamics

Bitcoin's latest journey back to $100,000 has been profoundly influenced by broader macroeconomic forces, particularly U.S. monetary policy and global trade developments.The U.S. Federal Reserve's decision to maintain interest rates at 4.25%–4.5% on May 7, 2025, provided critical support for risk assets like Bitcoin, helping drive it above $100,000 the very next day on May 8. Markets have increasingly priced in potential rate cuts later this year, with futures markets indicating a 72% probability of easing by September—a scenario that historically benefits Bitcoin through increased liquidity and capital flows into alternative assets."Bitcoin's inverse correlation with the U.S. Treasury yield curve is at its strongest in over two years," notes Jurrien Timmer, Director of Global Macro at Fidelity Investments. "This reinforces its emerging role as a monetary hedge comparable to gold, but with significantly higher growth potential."Each of Bitcoin's three crossings above $100,000 has coincided with distinct macroeconomic catalysts. The initial December 2024 breakthrough came amid post-election optimism and a crypto-friendly regulatory appointment, the February 2025 move reflected growing institutional adoption, while this latest May resurgence has been driven by trade developments and monetary policy expectations.President Trump's "Liberation Day" tariffs announced on April 2, 2025, initially triggered a 32% Bitcoin price drop from $109,241 to below $75,000. However, the subsequent 90-day tariff truce and the May 8 U.S.-U.K. Trade Agreement—which maintained U.S. tariffs on British goods at 10% while lowering U.K. tariffs to 1.8%—restored market confidence and contributed significantly to Bitcoin's recovery above $100,000 on the same day.This rapid rebound amid trade tensions highlights a critical evolution in Bitcoin's market behavior: increasingly functioning as a hedge during periods of geopolitical uncertainty rather than simply correlating with risk assets—a pattern that has strengthened with each journey beyond the $100,000 milestone.

Technical Dynamics: On-Chain Metrics and Market Structure

As Bitcoin consolidates above the $100,000 threshold, technical and on-chain metrics provide critical insights into the sustainability of the current rally and potential future price trajectories.

Supply Dynamics and Scarcity PremiumBitcoin's supply mechanics have become increasingly favorable, with exchange balances declining to five-year lows. "The amount of Bitcoin available on exchanges has dropped 12% since January," explains Willy Woo, on-chain analyst and investor. "This supply contraction coincides with record institutional demand, creating the perfect conditions for price discovery above $100,000."The ongoing supply squeeze is further intensified by Bitcoin's recent halving event, which reduced the mining reward to 3.125 BTC per block. This structural reduction in new supply—occurring just as institutional adoption accelerates—represents a powerful catalyst for continued price appreciation.

Technical Structure and Price LevelsFrom a technical perspective, Bitcoin's breach of the psychological $100,000 barrier opens the path to test January's all-time high near $109,000. Key resistance levels exist at $107,000, with short-term support established at $95,000 following the recent consolidation."The weekly close above $100,000 confirms a major technical breakout," notes Katie Stockton, founder of Fairlead Strategies. "The measured move target suggests potential for Bitcoin to reach $110,000-$120,000 in the coming months, assuming the breakout holds."

Derivative Markets and Leverage ConditionsBitcoin's derivatives landscape reflects growing institutional sophistication, with open interest on CME Bitcoin futures reaching record levels of $5.2 billion. Unlike previous cycles characterized by excessive retail leverage, the current market structure shows healthier funding rates and more sustainable positioning.The put/call ratio for Bitcoin options has normalized to 0.84 after reaching extreme levels of 1.2 during April's tariff-driven selloff, indicating balanced market sentiment rather than excessive bullishness—typically a positive sign for sustained price appreciation.

Correlation Shifts and Bitcoin DominanceBitcoin's correlation with traditional risk assets has weakened significantly in 2025, with its 90-day correlation to the Nasdaq dropping from 0.72 in January to 0.41 currently. This correlation breakdown coincides with Bitcoin's market dominance exceeding 60% for the first time since 2021, signaling renewed focus on Bitcoin's fundamentals rather than broader cryptocurrency speculation."Bitcoin reasserting dominance above 60% alongside its $100,000 milestone reinforces its unique position in institutional portfolios," explains Lyn Alden, investment strategist. "Analysts project dominance could reach 71% in coming months as capital increasingly concentrates in the market leader."

Global Regulatory Landscape and Outlook

Bitcoin's $100,000 milestone arrives amid a transformative period for cryptocurrency regulation globally. The U.S. regulatory environment has shown signs of increasing accommodation, with the Treasury Department reportedly exploring the concept of a strategic Bitcoin reserve. Meanwhile, the European Union's Markets in Crypto-Assets (MiCA) regulations have provided operational clarity for institutional participants, further supporting Bitcoin's integration into the traditional financial system.Looking ahead, several catalysts could propel Bitcoin beyond its current levels:

Central Bank Digital Currency (CBDC) Development: As major economies advance CBDC initiatives, Bitcoin's role as a non-sovereign alternative becomes increasingly relevant, particularly in regions with currency instability.

Institutional Product Expansion: Beyond spot ETFs, the potential approval of Bitcoin options ETFs and other sophisticated investment vehicles would significantly expand institutional participation.

Corporate Treasury Adoption: Following MicroStrategy's model, several Fortune 500 companies are reportedly exploring Bitcoin allocations, with announcements potentially triggering new waves of corporate adoption.

Just one step to unlock the rest of this article

Sign in to read the full article and access exclusive content

✨ Completely free • No credit card required