Amazon Stock Golden Cross: 2025 Forecast, Prime Day Impact, and AWS Growth vs. Microsoft & Google

July 8, 2025 - Market Analysis by Alex Grant

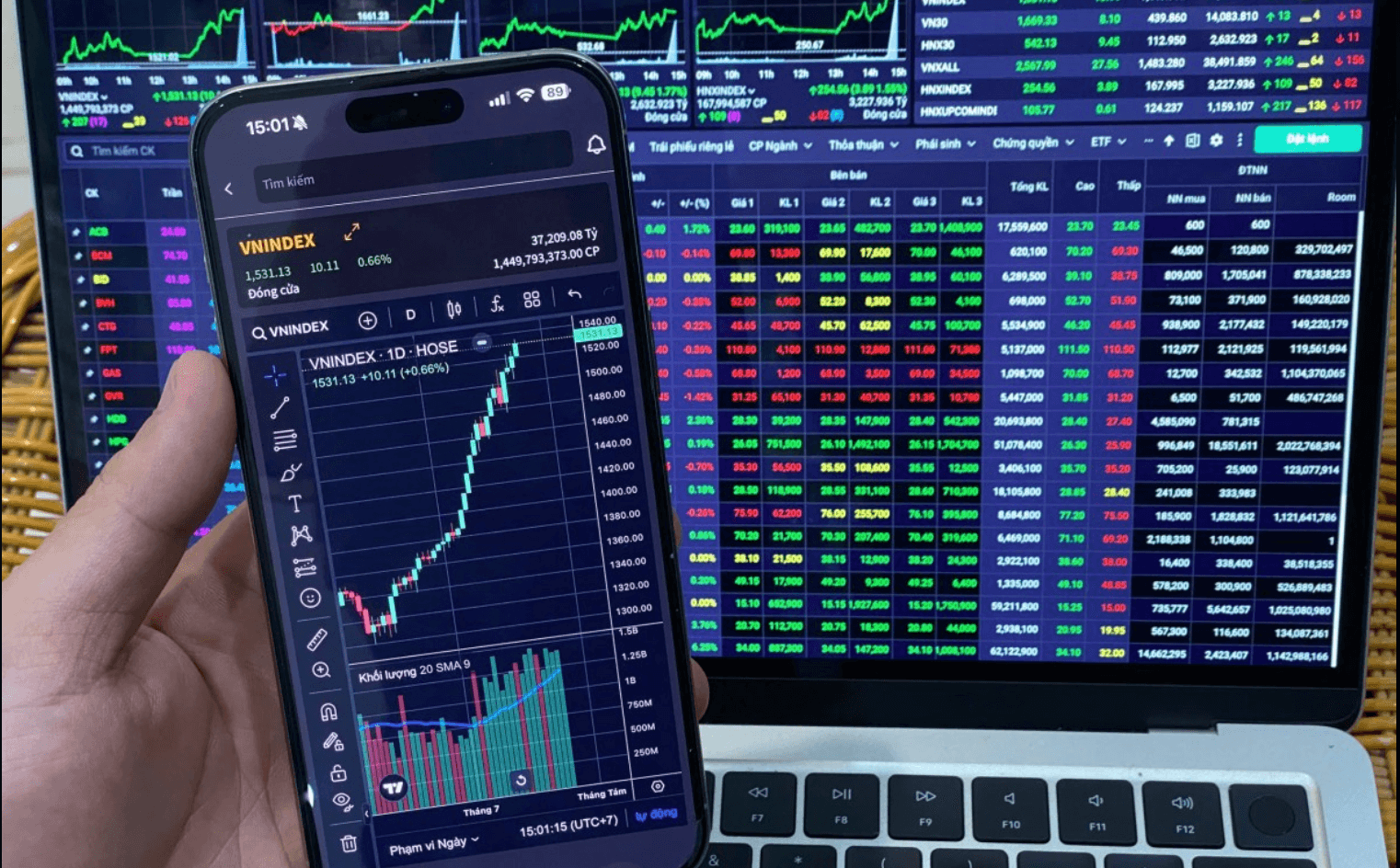

Amazon's stock just flashed a major bullish signal that has Wall Street buzzing. The e-commerce and cloud giant formed a "golden cross" pattern today—a technical indicator that historically precedes average gains of 15-25% over the following 12 months for large-cap tech stocks. This technical breakthrough coincides perfectly with Amazon's four-day Prime Day 2025 event launching today, creating a dual catalyst that has traders' attention.

But with Microsoft's Azure growing at 21-33% annually and Google Cloud expanding at 25-30%, can Amazon maintain its dominance across multiple fronts?

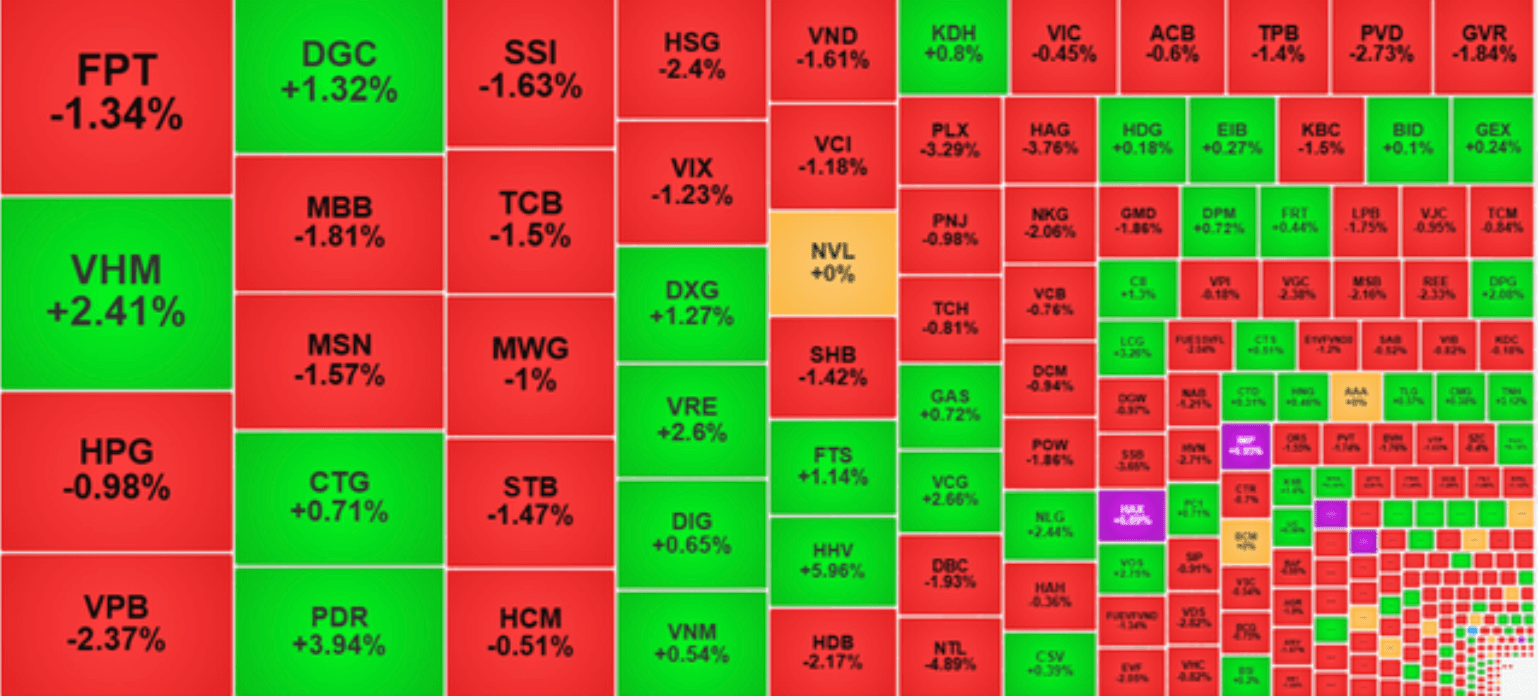

Let's break down what this means for investors, especially those watching from Southeast Asia where Amazon's growth story directly impacts regional markets and currencies.

The Golden Cross: More Than Just Chart Candy

A golden cross occurs when a stock's 50-day moving average crosses above its 200-day moving average. Think of it as the market's way of saying "the short-term trend is now stronger than the long-term trend." For Amazon, this technical signal coincides perfectly with Prime Day 2025, creating a dual catalyst that has traders' attention.

Amazon shares have climbed steadily since their April lows, with the relative strength index (RSI) still below overbought territory. Translation: there's room to run higher. Key resistance levels sit at $243 and $268, while major support holds near $216.

But here's the kicker—this isn't just about pretty charts. Amazon's fundamentals are backing up the technical story.

The Three-Engine Growth Machine

Amazon isn't your typical retailer anymore. It's a diversified tech conglomerate firing on three cylinders:

AWS (The Profit Engine): Amazon Web Services maintains a commanding 29-30% cloud market share, growing 17% year-over-year with 4.19 million business customers—up 357% since 2020. While Microsoft Azure (24-25% share, 21-33% growth) and Google Cloud (11-13% share, 25-30% growth) are gaining ground, AWS remains the profit center that funds Amazon's other ventures. The AI boom is accelerating demand for cloud infrastructure, with Amazon significantly expanding its AI capabilities and infrastructure investments this year.

E-commerce (The Volume Play): Amazon captures roughly 13% of global desktop shopping traffic. Sure, Shopify is growing faster at 8% year-to-date versus Amazon's 1-2%, but Shopify is a platform that actually partners with Amazon to expand merchant reach. It's like comparing a highway (Amazon) to the company that builds on-ramps (Shopify).

Advertising (The Dark Horse): Here's where Amazon is really surprising competitors. The company's ad business is projected to exceed $60 billion in 2025, now representing about 9% of total revenue but growing 17-20% annually—significantly faster than Google's 10% and Meta's 8%. When you control the shopping journey from search to purchase, you own incredibly valuable real estate for advertisers.

How Amazon Stacks Against the Competition in 2025

Just one step to unlock the rest of this article

Sign in to read the full article and access exclusive content

✨ Completely free • No credit card required